What is Batting Average in Finance?

Sean P. Gilligan, CFA, CPA, CIPM and Jocelyn Mullis, CFA, CIPM

October 27, 2021

In baseball, Batting Average is one of the oldest and most universal tools to measure a player’s success at the plate. Similarly, Batting Average is used in investment performance analysis to measure a manager’s success “at bat,” but there is significantly less cheering involved by spectators!

What is Financial Batting Average?

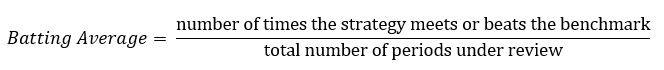

When used for investment performance analysis, Batting Average is a statistic that measures how often a manager or strategy outperforms its benchmark. It is calculated by taking the number of times the strategy beats the benchmark divided by the total number of instances in the period (whether daily, monthly, quarterly, etc.).

Financial Batting Average Formula

How to interpret Batting Average

Batting Average allows managers to demonstrate how consistently they outperform. The closer this number is to 1.000 (or 100%) the better. A strategy with a batting average of 0.500, has outperformed its benchmark only half the time, whereas a strategy with a batting average of 1.000 has consistently outperformed the benchmark for every period under review. For example, a strategy that beat the index 18 out of 36 months would have a statistical batting average of 0.500 or 50%.

Luckily, we hold our investment managers to a higher standard than players in the MLB. While a baseball batting average of 0.300 (or 30%) may be considered outstanding, 0.500 (or 50%) is often considered a minimum threshold to be considered successful in investment management.

Why is Batting Average Important?

Like many statistical tools, Batting Average is used to assess whether a strategy is performing according to its investment objective. If the goal of the strategy is to consistently outperform its benchmark, Batting Average is an easy calculation to assess whether this is true.

Batting Average is particularly useful in demonstrating consistency. For example, in baseball, a player with 4 RBIs (runs batted in) in a game may have had a grand slam in one at-bat and struck out every other time at the plate. Another player with 4 RBIs may have hit a solo homerun every time he batted that game. While their RBIs are the same, the second player has a much higher Batting Average for the game because he was more consistent. Similarly, when assessing an investment manager’s performance, investors are often looking for consistency – to determine if the manager had one period with significant outperformance but underperforms most periods, or if the manager consistently outperforms. Batting Average can help explain this.

One drawback to using Batting Average is that it focuses only on returns and does not consider the risk taken by a strategy to achieve those returns. It is therefore a good idea to use Batting Average in addition to other statistical measures to demonstrate skill when considering risk. The Information Ratio is a common measure used in conjunction with Batting Average. It is similar in that it evaluates a strategy’s success beyond the benchmark, but it takes into account the volatility (or risk) of achieving those returns.

Contact Us

If you have any questions about investment performance or GIPS compliance Contact Us or email Sean Gilligan, CFA, CPA, CIPM at sean@longspeakadvisory.com.